Introduction

The growing trend of the global economy, the increasing demand for energy, the critical role of oil and gas in the growth and development of industries, and the advancement of human knowledge for optimal use of natural resources make it inevitable to pay more attention to the dominant role of oil and gas. Ilam Petrochemical Company, with approximately 2,000 specialized personnel and workers, is the largest private company in Ilam province and the biggest petrochemical complex in western Iran. This company began production in 2013, and its second phase (Ethylene Unit) is about 70% physically complete and will be the first ethylene unit in the western part of the country. Ilam Petrochemical Company has an annual production capacity of 300,000 tons of polyethylene and is currently operating at 50% capacity.

COMFAR

COMFAR, an acronym for “Computer Model for Feasibility Analysis and Reporting,” is software developed by the United Nations Industrial Development Organization (UNIDO). It is used for project analysis, financial planning, and economic evaluation. This software is a comprehensive and flawless tool in the field of engineering economics. COMFAR serves as a common language between industrial engineers and accounting experts, providing results and standard analyses that meet global criteria for economic projects, whether industrial, mining, agricultural, or otherwise. COMFAR effectively eliminates human and computational errors in financial and economic project analyses.

It can conduct economic analyses of various projects, whether new, renovation, development, joint ventures, or privatizations. In this way, COMFAR assists investment development experts in thoroughly executing the analysis process for the projects under consideration, ultimately providing a suitable environment for high-level managers to make informed decisions regarding project evaluation and prioritization.

The specialized COMFAR software is a computer program supporting pre-operational research designs and facilitating the organization and calculation of financial and economic reports. This software is designed based on feasibility studies or the viability of a project and opportunity assessments for each industrial and mining project. The results reflect the economic attractiveness of the projects based on the limited or unlimited budget of the executing organization.

Petrol Company

Petrol Company controls three manufacturing companies, each of which holds a significant share in the petrochemical industry. Ilam Petrochemical Company, inaugurated in 2020, is a value-added petrochemical complex that processes gas into ethylene and ultimately produces high-demand heavy polyethylene, specifically the F7000 grade, known for its quality.

In 2021, this company produced over 191,000 tons of HD (heavy polyethylene) as its final product, with a sales value exceeding 55 trillion rials, and the export value in that year surpassed 36 trillion rials. The remainder of the company’s products met domestic market needs through the commodity exchange. It is evident that given its location in the underdeveloped region of Ilam in western Iran, the company has also contributed significantly to the local economic development.

Process Description

The stages of economic evaluation involve the collection of data:

– Technical Data: Unit capacity, input and output material balance, technology and process descriptions, equipment specifications and costs, energy consumption (electricity, water, steam, etc.).

– Economic Data: Capital investment (CAPEX), operating costs (OPEX), raw material costs (pyrolysis gasoline), product prices (benzene and by-products), financial costs (interest rates, loan conditions), depreciation methods, taxes, and fees, inflation rates.

– Market Data: Forecasts for benzene supply and demand, prices, and market trends, competition.

Inputting Data into COMFAR: Define the title, location, and scope of the project, starting date, and operational lifespan.

– Capital Investment Costs: Breakdown of capital costs into land, buildings, machinery, and other initial costs, including installation, commissioning, and initial working capital.

– Operating Costs: Detailed breakdown of raw material costs, labor, maintenance, energy, and other operational expenses.

– Revenue: Inputting projected revenue from benzene and by-product sales.

– Financing: Defining the financing structure (equity, loans, grants), entering loan details such as interest rates, repayment schedules, and grace periods.

– Economic Environment: Inputting assumptions for inflation, exchange rates, and economic conditions.

By following these steps and utilizing the powerful capabilities of COMFAR, a comprehensive economic evaluation of the benzene extraction unit from pyrolysis gasoline can be achieved, leading to valuable insights regarding the project’s financial feasibility and aiding investment decision-making.

Conclusion

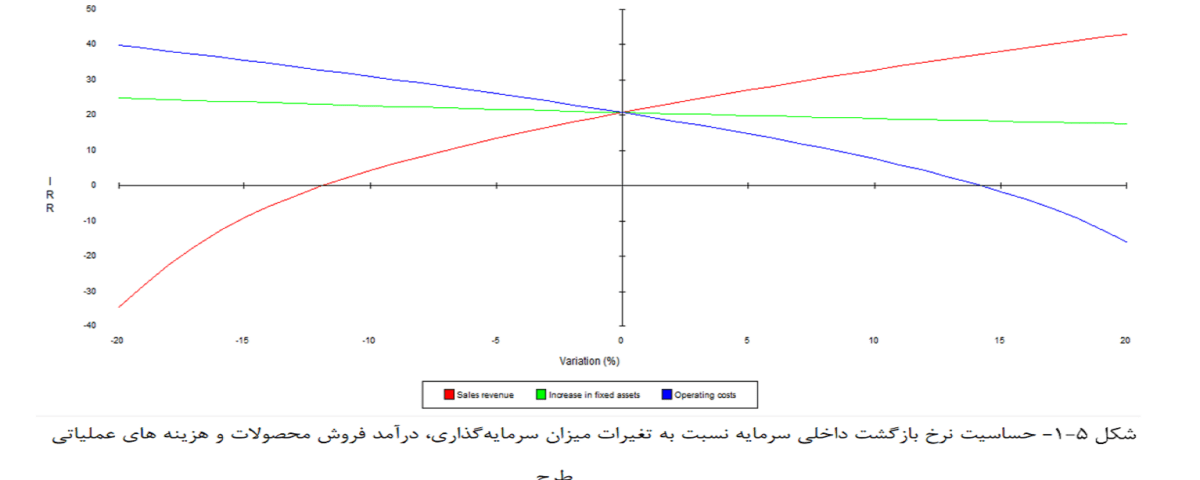

The economic evaluation using COMFAR confirms the strategic investment decision for the benzene extraction unit at Imam Petrochemical Company. The analyses indicate that this project is expected to be economically viable, profitable, and sustainable, contributing positively to the company’s financial performance and strategic objectives.

APIPCO, leveraging deep technical expertise, is capable of providing comprehensive solutions for benzene extraction from pyrolysis gasoline. This company has successfully implemented various projects in this field, including:

1. Providing aromatic technical knowledge to Marun Petrochemical Company.

2. Delivering COMFAR and pre-feasibility studies.

3. Providing initial technical knowledge and pre-feasibility studies for the implementation of projects for Ilam Petrochemical Company and Petrol.