Introduction

The Maroon Petrochemical Company has been established on a land area of 102.5 hectares in two geographical locations:

1. Krit Camp Area in Ahwaz

The ethane recovery unit is built on an area of 9.5 hectares, located 15 kilometers along the Ahwaz-Mahshahr road. In this unit, feedstock for the olefin unit is produced and sent to the special economic zone for petrochemicals via a 95-kilometer pipeline.

2. Special Economic Zone for Petrochemicals

The olefin unit, along with heavy polyethylene, polypropylene, ethylene oxide, ethylene glycol, and auxiliary services, is established on 93 hectares in Site 2 of the Imam Khomeini (RA) petrochemical special economic zone.

The olefin unit of Maroon Petrochemical Company, with an annual production capacity of 1.1 million tons of ethylene, is one of the few mega-olefins that has been commissioned globally. This massive unit plays a crucial role in transforming hydrocarbons into polymeric and petrochemical materials, producing 1,100,000 tons of ethylene and 200,000 tons of propylene as its main products. Valuable by-products such as pyrolysis heavy C3+, methane, and hydrogen are also generated from the olefin unit.

Process Description

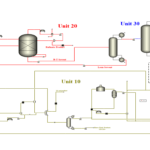

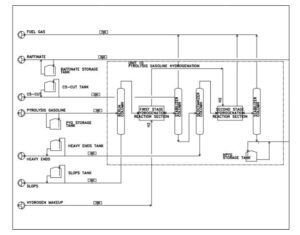

To conduct an economic assessment of a benzene extraction unit from Maroon’s pyrolysis gasoline (pygas), the following steps are involved:

1. Define the Scope and Objectives:

Determine the extraction unit capacity, desired purity of extracted benzene, process flow, and technology used.

2. Technical Feasibility:

Evaluate benzene extraction technology options such as solvent extraction, adsorption, or distillation, and the compatibility of the selected technology with Maroon pygas.

3. Capital Expenditures (CapEx):

– Design and Equipment: Costs associated with reactors, separation units, and other essential equipment.

– Installation: Costs of site preparation, installation, and commissioning.

– Engineering and Design: Process design costs, project management, and feasibility studies.

4. Operational Expenses (OpEx):

– Raw Materials: Costs for Maroon pygas feedstock and any required additional chemicals.

– Energy: Heating, cooling, and electricity costs.

– Labor: Salaries for operating and maintenance staff.

– Maintenance: Regular maintenance and repair costs.

– Waste Disposal: Costs for handling and disposing of by-products and waste.

5. Revenue Forecasting:

– Estimate the volume of benzene produced and its market price.

– Consider additional income from by-products or enhanced pygas quality.

6. Financial Analysis:

– Break-Even Analysis: Determine the point at which revenues equal expenses.

– Net Present Value (NPV): Calculate the present value of cash flows considering capital costs.

– Internal Rate of Return (IRR): Calculate the rate of return on investment.

– Payback Period: Assess the time required to recover the initial investment.

7. Risk Assessment:

– Identify potential risks and their impact on the project.

– Develop strategies to mitigate risks.

By thoroughly considering these factors, we can conduct a comprehensive economic assessment of the benzene extraction unit.

Conclusion

In conclusion, the benzene extraction unit from Maroon’s pyrolysis gasoline presents a promising economic opportunity, given favorable market conditions and efficient operational management. Strategic planning, risk reduction, and continuous process optimization are essential to maximize economic benefits and ensure long-term profitability.

Economic Evaluation of Benzene Recovery Unit from MARUN Pyrolysis Gasoline by Aspen Plus

In this project, the economic evaluation of the benzene extraction unit from MARUN pyrolysis gasoline has been simulated using Aspen Plus software.