Introduction

Methanol, a key intermediate in the chemical industry, has garnered significant attention due to its potential as an economical and versatile feedstock. Its production, primarily from natural gas and biomass, plays a vital role in various applications, including fuel, solvents, and as a precursor for materials such as formaldehyde and acetic acid. The economic analysis of methanol focuses on production costs, market demand, and supply dynamics while also examining its competitive position against other energy sources.

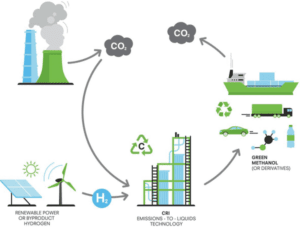

With fluctuations in energy prices and an increasing interest in renewable energy, the methanol market is undergoing changes that could impact its economic viability. Additionally, policies promoting clean fuels and reducing greenhouse gases may enhance methanol’s role as a sustainable energy carrier, influencing investment decisions and long-term profitability in this sector. Analyzing these factors is essential for stakeholders to make informed decisions in a changing market.

The need for clean energy is imperative, and methanol is emerging as an alternative energy source. Methanol production typically occurs from synthesis gas derived from steam reforming methane or naphtha, but it can also be produced from methane oxidation or CO2 reduction with hydrogen. These methods facilitate a carbon-neutral cycle and decrease dependence on fossil fuels.

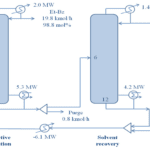

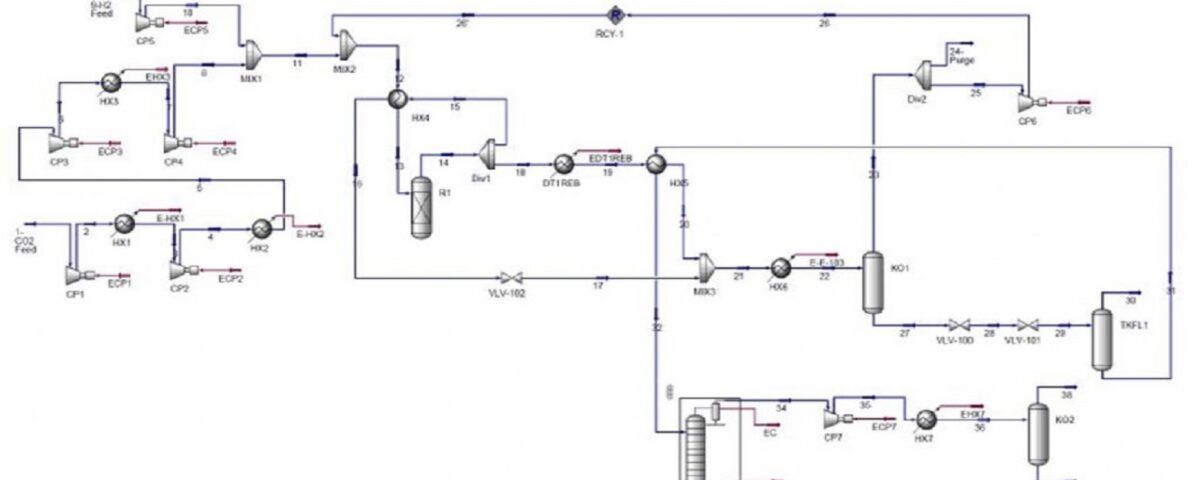

Process Description

The economic analysis process for methanol involves several key stages that aid in assessing the economic capabilities of this substance. It begins with gathering data regarding production costs, such as raw material, energy, and equipment costs. Subsequent analysis of the methanol market and demand and supply forecasts helps determine whether methanol production is economically viable.

Next, sensitivity analyses are conducted to assess the impact of fluctuations in raw material prices, changes in energy costs, and political developments on project profitability. Additionally, evaluating alternative markets and competitors assists in establishing methanol’s competitive position. Finally, using financial models and economic indicators such as the Internal Rate of Return (IRR) and Payback Period (PBP), conclusions regarding the economic feasibility of producing and utilizing methanol across various industries are drawn. This process aids decision-makers in formulating appropriate strategies for market entry or investment in this field.

Conclusion

In conclusion, the economic analysis of methanol reveals that this substance holds significant potential for development and investment as a chemical feedstock and energy carrier. Considering the fluctuations in energy prices and the rising demand for clean and sustainable fuels, methanol production may present an attractive option in alignment with environmental objectives and greenhouse gas reduction.

Furthermore, technological advancements in production processes and the utilization of renewable resources could reduce production costs and enhance efficiency. However, challenges such as competition with other energy sources and shifts in market policies must be managed carefully. Overall, the economic analysis of methanol illuminates not only the opportunities but also the threats present in this market, enabling decision-makers to develop effective strategies for optimal utilization of this valuable material.