Simulation of Aspen Hysys and Optimization Process

مهر ۴, ۱۴۰۳

Introduction to Aspen ONE V12 Software Suite

مهر ۴, ۱۴۰۳Introduction

In any organization, depending on the volume and complexity of activities, the rate of knowledge production can exceed the organization’s ability to implement and utilize all generated knowledge. Therefore, establishing a systematic and purposeful framework for decision-making regarding the acceptance or rejection of an idea or project for knowledge application has always been and remains a concern for organizations. Generally, investment project evaluations occur from three perspectives.

Feasibility studies for projects consist of three main components: market studies, technical studies, and financial studies. Since a project can only be justifiable in one or two of these areas, positive evaluation results from one phase cannot lead to final project acceptance. Thus, the feasibility of a project means justification across market, technical, and financial studies.

Feasibility of Industrial Projects

A comprehensive feasibility report must establish a meaningful connection between market, technical, and financial chapters. This depends on observing several essential points during the project proposal process. For example, in industrial project feasibility studies, production capacity is often presented based on factors like machinery capacity, available capital, available workforce, and even land size. Similarly, the selling price of the project’s products is determined based on the cost of production plus a desirable profit margin.

Although initial assessments may not seem erroneous, attention to proper feasibility study execution reveals significant errors. This understanding is crucial for preparing a project proposal and conducting feasibility studies effectively.

Justification of Projects in Market, Technical, and Financial Dimensions

In market studies, the core question is whether the existing demand in the target market allows a new supplier’s entry. In simpler terms, market feasibility means conditions must exist for a new producer to enter a defined market, necessitating sufficient demand for the product.

The technical justification of a project depends on the comprehensiveness of these estimates and the assurance of their feasibility. Another aspect here is the practicality of the proposal.

Four Main Elements for Project Feasibility Studies

1. Technical Feasibility: Analyzes the available technical resources for your project, determining if adequate equipment, sufficient quantity, and appropriate technical knowledge exist to meet project goals.

2. Financial Feasibility: Assesses whether the project is financially viable, including a cost-benefit analysis and forecasting expected return on investment (ROI) while outlining financial risks.

3. Market Feasibility: Evaluates how the delivered project products are expected to perform in the market, comprising market analysis, competitive analysis, and sales forecasting.

4. Operational Feasibility: Assesses whether an organization can complete the project by considering employee requirements, organizational structure, and applicable legal requirements.

COMFAR Software

COMFAR, short for “Computer Model for Feasibility Analysis and Reporting,” was developed by the UNIDO’s economic evaluation unit in 1979. Based on the experiences of over 30 economic evaluation committees from various countries, it was introduced commercially in 1983 after three years of testing.

The software performs financial project analyses, allowing users to calculate:

– Net present value

– Internal rate of return

– Payback period of investments

– Financial evaluations

COMFAR supports business plans, revenue forecasts, and cost estimations for industrial, mining, agricultural, infrastructure, and maritime projects. The program organizes and simplifies the preparation of financial and economic reports, helping assess the feasibility and viability of industrial and mining projects based on available economic budgets.

COMFAR Software Inputs:

1. Project Definition

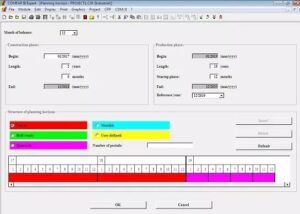

2. Time Planning (Construction Phase, Operating Phase)

3. Products

4. Monetary Units (Domestic Currency, Foreign Currency)

5. Inflation (Domestic and Foreign)

6. Partnerships (Domestic and Foreign)

7. Discounting (Overall Investment Discount Rate, Shareholder Discount Rate)

COMFAR Software Outputs:

1. Financial Analysis

2. Fixed Investment Estimate

3. Working Capital Estimate

4. Annual Production Cost Estimate

5. Annual Depreciation of Investments Estimate

6. Total Capital Requirement Estimate

7. Cost Price Breakdown by Expenses

8. Funding Sources Identification and Financial Costs

9. Income and Expense Analysis

10. Profit and Loss Performance Determination for Total Investment and Shareholder Contributions

11. Economic Studies

12. Net Cash Flow Determination for Total Investment

13. Discounted Cash Flow (DCF) Analysis

14. Internal Rate of Return (IRR)

15. Net Present Value (NPV)

16. Payback Period (PBP) for Total Capital

17. Payback Period for Shareholders’ Contributions

18. Investment Payback Period Determination

19. Break-even Analysis

20. Profitability Index (PI)

21. Sensitivity Analysis for Unforeseen Expenses

22. Project Sensitivity Analysis

23. Risk Analysis

24. Financial Ratios Analysis

25. Interdependencies Analysis of Projects

26. Financial Statements Preparation

Feasibility Study with COMFAR

The preparation of a feasibility study using COMFAR helps assess whether a project will succeed or fail. It evaluates the practicality of your project plan to judge if you can proceed with the project.

Feasibility studies and project assessments via COMFAR are vital for projects that represent significant investments for your business and have a considerable potential impact on your market presence.

As a project manager, you may not be responsible for directly conducting feasibility studies, but understanding these studies is essential.

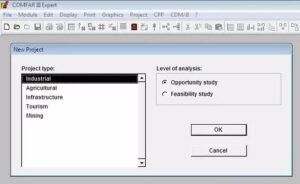

Analysis Levels in COMFAR Software:

There are two different frameworks:

1. Opportunity Study

2. Feasibility Study

An opportunity study is a quick tool for identifying and estimating the attractiveness of a business opportunity in the market. Before undertaking any project, preliminary studies like opportunity and feasibility studies are necessary.

The opportunity study identifies investment opportunities, prepares project ideas, collects necessary data, and evaluates initial data. Its main goal is to promote investment projects in specific activity areas.

The feasibility study provides the technical, economic, and financial basis for investment decisions regarding a project at a specific time, considering uncertainties and risks. The analysis results must indicate the financial resources required for operational needs and fulfilling all financial obligations.

Contents of a Feasibility Study:

This study can vary in detail according to the client’s needs and typically includes:

1. Applicant’s historical report

2. Market studies

3. Technical studies

4. Results from COMFAR software

5. Financial analyses

6. Market studies

Example Project with COMFAR (Economic Viability of Scheme):

Any project must have economic and technical justification before execution. For example, if a factory for food products is to be established, market studies must precede it to justify its need and technical feasibility.

The steps include:

1. Market studies

2. Technical justification

3. Financial justification

During the financial justification phase, decisions regarding investment must be made, including the internal return rate and net present value calculations.

Upon opening the software and selecting New, you provide project information, categorizing it under opportunity or feasibility study. Economic projects are classified into five categories:

1. Industrial

2. Agricultural

3. Infrastructure

4. Tourism

5. Mining

As you complete each step, COMFAR adds a green box, forming a tree structure to enter information. Subsequent boxes include:

1. Products

2. Monetary units

3. Cost center structure

4. Inflation rates

5. Potential partners

6. Discounting

7. Fixed investment costs

8. Production costs

9. Sales program

10. Working capital

11. Financing sources

12. Taxes, etc.

Project Justification Example:

For a benzene and toluene extraction project from pyrolysis gasoline, COMFAR supports pre-operational research. It facilitates the organization and calculation of economic reports while assessing the technical and financial feasibility of the scheme to secure investment.

The software strategy involves thoroughly analyzing product details, market requirements, production possibilities, and necessary investments to enable transparent economic decisions.

Conclusion

COMFAR has simplified and enhanced the accuracy of analyzing industrial and non-industrial projects. By analyzing various types of projects, it aids experts in investment development to execute comprehensive assessments, ultimately facilitating effective decision-making regarding project evaluation and prioritization within organizations.